Saturday, August 25

10:30 am – 1:30 pm

Tax Myths and Misconceptions

Many individuals and small business owners are unaware of their tax responsibilities.

Many individuals and small business owners are unaware of their tax responsibilities.

- Following are just a few of the misconceptions:

- My accountant is responsible for my business taxes;

- I do not need an EIN if my business is registered as a LLC;

- I can avoid paying taxes by hiring people as contractors; and

- I can pay any salary to myself when my business is a sole proprietorship or if I am a general partner.

Featured Topics

- Overview – Business Tax Structure.

- Calculating Taxes – different types; and who should pay them

- Consequences of failing to file and pay taxes.

- Federal Business Tax Forms and whether to do it yourself or hire a tax expert.

- State Business Income Tax (Franchise Tax) – how to calculate it and report it.

- Payroll Taxes including: Social Security, Medicare, Federal, State and Unemployment Taxes.

- Calculating Payroll Taxes – when to pay

- Contract Employees vs. Employees – Tax differences

- Sales Tax – a business owner’s responsibilities

- New Tax Laws- Brief Overview – How they impact small business owners.

Invest in Peace of Mind

Avoid the pitfalls. You are responsible for your business taxes and failure to comply with tax laws has severe consequences, including your personal and business income garnishment, lien on business and personal assets and, in the case of intentional fraud, jail. Learn, save time, money and your peace of mind.

Avoid the pitfalls. You are responsible for your business taxes and failure to comply with tax laws has severe consequences, including your personal and business income garnishment, lien on business and personal assets and, in the case of intentional fraud, jail. Learn, save time, money and your peace of mind.

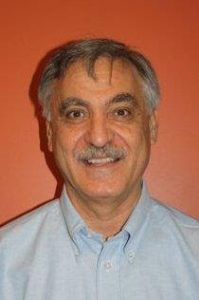

Featured Presenter – Mo Tehrani

Dr. Mohammad (“Mo”) Tehrani started his first business in 1995. He has co-owned and still co-owns and/or invests in multiple businesses in varying sectors: real estate, pharmacy; security systems; and accounting. Currently he is a consulting partner with a public accounting firm in Houston, Texas. He is also a full-time professor of accounting at Houston Community College. Dr. Tehrani, started out in neurochemistry and has a BS in Biology/Geology, an M.Ph in Human Biology, a Ph.D in Neurochemistry. When he and his brother ventured into business ownership, he also enrolled in the Accounting program at University of Houston and became a CPA in 1999. Mo has volunteered with various organizations such as the BCM-Credit Union, where he served on the Board of Directors. He joined SCORE in July 2012 and has served in varying positions in addition to his ongoing role providing counseling to small business owners. Dr. Tehrani is now incoming President of SCORE Houston.

Dr. Mohammad (“Mo”) Tehrani started his first business in 1995. He has co-owned and still co-owns and/or invests in multiple businesses in varying sectors: real estate, pharmacy; security systems; and accounting. Currently he is a consulting partner with a public accounting firm in Houston, Texas. He is also a full-time professor of accounting at Houston Community College. Dr. Tehrani, started out in neurochemistry and has a BS in Biology/Geology, an M.Ph in Human Biology, a Ph.D in Neurochemistry. When he and his brother ventured into business ownership, he also enrolled in the Accounting program at University of Houston and became a CPA in 1999. Mo has volunteered with various organizations such as the BCM-Credit Union, where he served on the Board of Directors. He joined SCORE in July 2012 and has served in varying positions in addition to his ongoing role providing counseling to small business owners. Dr. Tehrani is now incoming President of SCORE Houston.

Fee: $25.00 on line, $30.00 at the door.

Includes lunch

Veterans: Free for first 10 Veterans, Thanks to Capital One Bank (Code: VETS)

Don’t miss this exciting learning opportunity!

Sincerely,

Sandra Louvier

Director

Center for Entrepreneurship

Houston Community College – Northwest